Many homeowners across the country are struggling to make their mortgage payments as a result of the COVID-19 pandemic. If you are facing money struggles and are worried about foreclosure, you are not alone. Mortgage assistance options are likely available to you and it’s crucial that you know your rights and what to do next. Here’s our guide to your options.

Foreclosure and Forbearance Defined

Foreclosure is when a lender takes back a property after the homeowner fails to make required payments on a mortgage. While processes vary state-to-state, federal law typically prohibits the foreclosure process from beginning before a loan is more than 120 days past due.

Forbearance is when your lender allows you to pause or reduce your mortgage payments for a limited time while you regain stability of your financial situation. Most homeowners have the right to forbearance for coronavirus-related financial hardship.

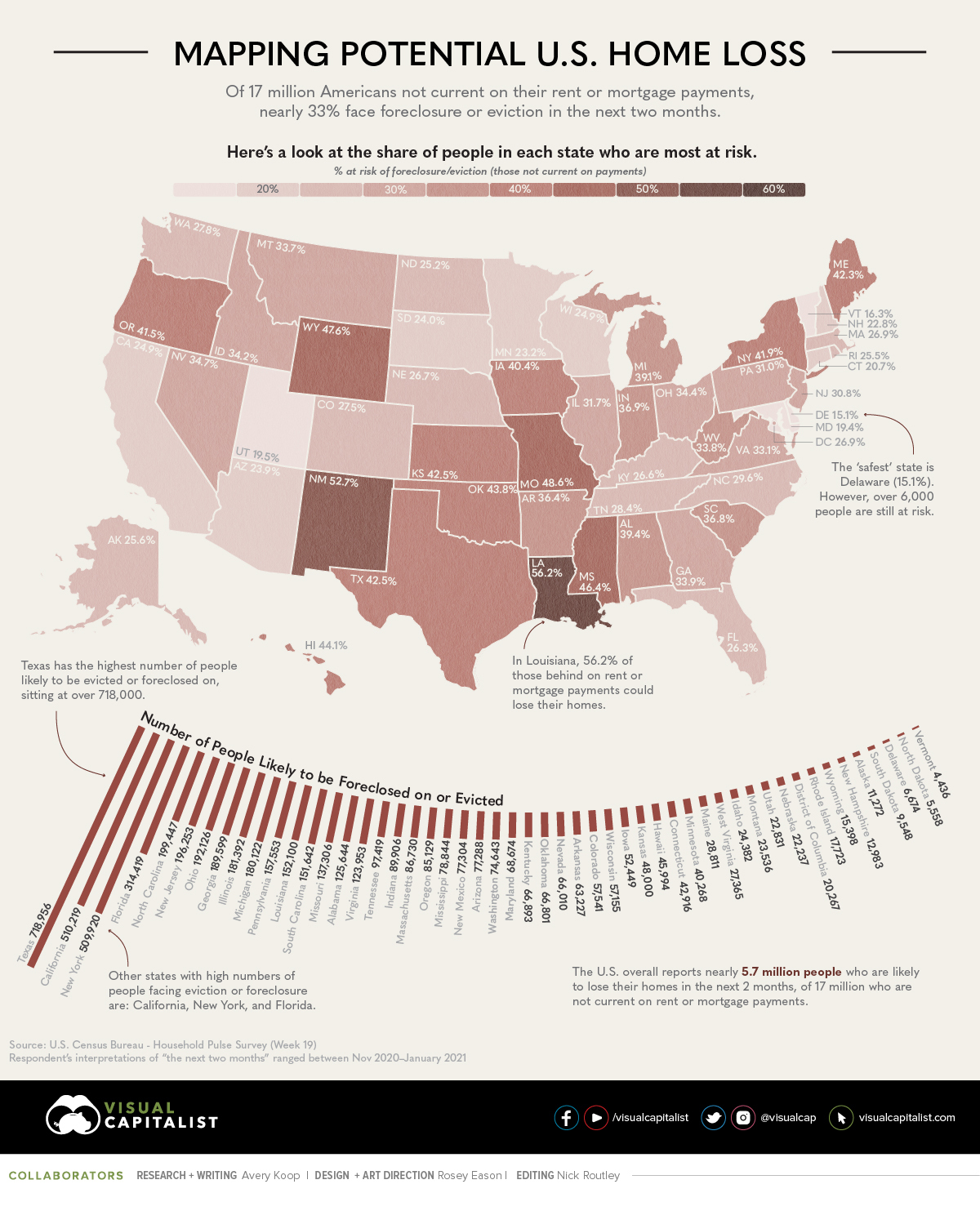

Source: Visual Capitalist

The CARES Act and What It Means for You

The Coronavirus Aid, Relief, and Economic Security (CARES) Act is an economic relief package designed to protect the American people from the public health and economic impacts of COVID-19. Under the CARES Act, homeowners with federally-backed loans have the right to request and receive a forbearance period of up to 180 days. An extension of up to 180 additional days, for a total of 360 days, is also a possibility.

How to Request Mortgage Forbearance

Forbearance is not automatic. You must request it from your mortgage servicer or lender. Most servicers offer forbearance and others can provide options for all federally-backed and -sponsored mortgages, which includes FHA, VA, USDA, Fannie Mae, and Freddie Mac loans. You might start with the phone number on your mortgage statement or resources on your lender’s website.

For mortgages backed by some government agencies, the deadline to request forbearance is December 31, 2020. Others may not yet have specified a deadline, or may have specified a later date. If you have already requested forbearance and need an extension, it’s best to make the request before the end of the year.

Your servicer will send you a list of documentation you will need to apply for the mortgage assistance options available to you. Qualification requirements vary by lender, and it’s best to start the process as early as possible to determine your options.

What Impact Will Forbearance Have on My Credit?

Unless your lender has agreed not to report it, your forbearance will be reported to credit bureaus. But mortgage forbearance is less damaging to your credit score than a missed payment and helps you avoid foreclosure.

One important thing to note – if a homeowner elects to participate in forbearance, in most cases they need to wait to show 12 months of documented income and on time payments before refinancing or obtaining a new loan. We know of one homeowner who filed for forbearance earlier this year, did not end up needing to use it, and now cannot refinance his home until next Summer, which is disappointing with our current historically-low interest rates. Also here’s a guide with handy info on how forbearance can affect your credit.

What Happens After the Forbearance Period Ends?

Thankfully, homeowners who receive forbearance under the CARES Act are not required to repay their skipped payments in a lump sum once the forbearance period ends, and instead are offered a payment plan. Your mortgage servicer or a HUD-approved housing counselor can help you select a payment plan that works for your situation.

How Altamont Property Group Can Help

We want to ensure you have all the information you need to get the help you deserve. Be on the lookout for scammers offering to “help” you with your payments, and make sure to work directly with your mortgage servicer.

Taking action now can potentially help you avoid foreclosure. If you have questions regarding foreclosure and forbearance, give us a call and we can help point you in the right direction for help with expert guidance.

If your back is truly against a wall, sometimes selling your home is even an option. We want to make sure you make the wisest choice for your situation, taking your short- and long-term needs and best interests to heart first and foremost.

Questions? Comments? Curious on how you can plan to create the best outcome for your family? Connect with Collin O’Berry and Altamont Property Group today to learn more!

altamontpropertygroup@gmail.com

828-782-5582

Sources:

Consumer Finance

CARES Act

FDIC Foreclosure Prevention Toolkit