By Cameron Lewis

A Strategy to Combat Higher Interest Rates

Homebuyers are facing headwinds due to higher interest rates. Most feel confident that rates will decline over the next couple of years so there is a propensity to wait to purchase. But when rates drop most likely demand will increase making it harder to get a home under contract at a good price. How can a buyer take advantage of today’s “window of opportunity” purchasing now with less demand and still ending up with a mortgage payment that is affordable? Here is the solution: Purchase with a Short Term Interest Rate Buydown- then when rates drop refinance. Through the Movement Purchase Advantage Program many of our current buyers will be eligible to refinance in the future with no lender fees. It’s a simple one- two step!

Step One: Interest Rate Buydown

With the slowdown in demand due to rising interest rates, SELLERS are looking for every advantage they can get to make their listing stand out. One way to make a listing more attractive is to offer an interest rate buydown to a prospective buyer. Most buyers are looking at a 7% plus 30 Year Fixed Interest Rates! When selling- what if you could offer prospective buyers starting rates in the 4% range? Do you think that might get a buyer’s attention? You better believe it! An interest rate buydown is a financial incentive that allows a buyer to reduce their interest rate for a period of time, typically the first one to three years of the loan.

Typically, the seller will fund the buydown by offering a sales concession to the buyer. The buydown funds are then used to reduce the interest rate on the loan for the specified period of time. Our Homebuyer Flex Cash Program does just that. These funds can be used to fund a rate buydown and/or pay other closing costs. There are limitations as to how much the seller can pay based on several factors covered below- Allowable Sales Concessions.

There are Two Main Types of Mortgage Rate Buydowns: Permanent and Temporary

Permanent buydowns: With a permanent buydown, the interest rate is lowered for the life of the loan. This type of buydown is typically more expensive than a temporary buydown, but it can save the borrower a significant amount of money over time. In today’s market with the strong likelihood rates will drop and borrowers will refinance in the near future- permanent rate buydowns may not be the best option. A buyer may be spending additional money up front to buy down their rate over the life of their loan, but they may only keep the loan for a short period of time. They may never break-even or realize the benefit of the up- front funds they are spending to buy down their rate.

Temporary buydowns: With a temporary buydown, the interest rate is lowered for a specific period of time, typically one to three years. After that period, the interest rate will increase to the original rate. It will provide significant savings monthly savings in the short term. The buydown funds are deposited into an account with the lender and used to fund the buydown monthly. If you refinance or pay off your mortgage any unused balance in your buydown account is refunded to you or used to lower your loan payoff.

We Offer Three Different Temporary Buydown Programs

- 3/2/1 Buydown: The rate is 3 points lower in the first year, 2 points in the second year, and 1 point in the third. Then year 4-30 the buyer pays the locked in current market rate at the time of purchasing.

- 2/1 Buydown: The rate is 2 points lower in the first year, 1 point in the second year. Then year 3-30 the buyer pays the locked in current market rate at the time of purchasing.

- 1/0 Buydown: The rate is 1 point lower in the first year. Then years 2-30 the buyer pays. The locked in current market rate at the time of purchasing.

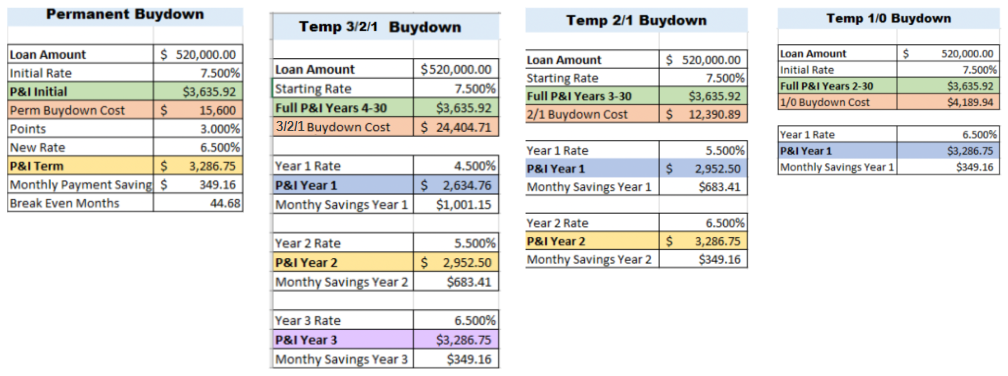

Example of Permanent and Temporary Rate Buydowns:

$650,000 Purchase Price

$520,000 Loan Amount (20% Down Payment

7.50% Interest Rate Conventional 30 Year Fixed Mortgage

- Permanent Buydown

- **For a buydown cost of $15,600 the buyer saves $349.16/month in payments over the life of the loan. If the buyer were funding their own buydown they would have about a 45 month breakeven.

- Temporary 3/2/1 Buydown

- For a buydown cost of $24,404 the buyer saves $1,001/month in Year 1, $683/month in Year 2, and $349/month in Year 3.

- Temporary 2/1 Buydown

- For a buydown cost of $12,390 the buyer saves $683/month in Year 1 and $349/month in year 2.

- Temporary 1/0 Buydown

- For a buydown cost of $4,189 the buyer saves $349.16/month for one year.

***These buydowns are available on FHA, FHA Manufactured, Conventional, and VA programs. They are also available on some Jumbo programs (Loan amount exceeding $726,200 for 2023 and $750,000 for 2024).

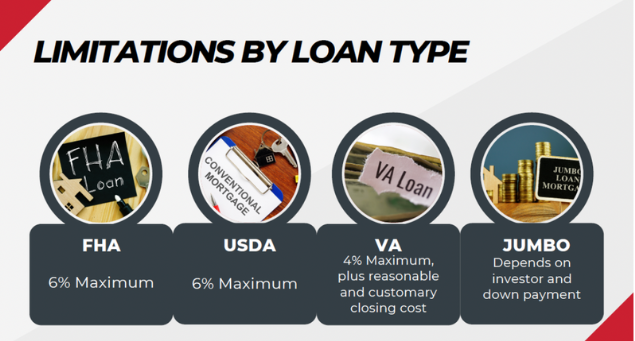

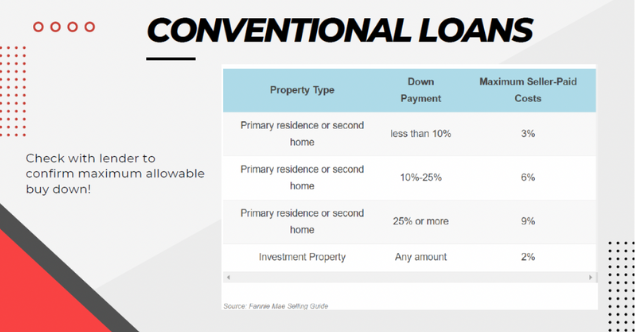

Sales Concession Limits

Keep in mind that buydowns can be funded by the seller, the buyer, or a combination of the two. With a Seller Funded Buydown there are limitations to the amount a seller may provide in sales concessions based on Loan Type. With Conventional Loans it’s also impacted by Occupancy Type and Loan to Value. For example, with a $650,000 Purchase Price the seller could provide maximum concessions of $39,000 with an FHA and USDA mortgage loan (6% Max). With VA it would be capped at $26,000 (4% Max). From the short term buydown illustrations above- you can see there would be plenty of money available to fund the buydowns.

How to Implement Mortgage Rate Buydown

If you are interested in implementing a mortgage rate buydown, you should work with a Lender and Realtor who are familiar with the program. With our Homebuyer Flex Program, we can help you determine which type of buydown is right for you and how much it will cost.

Remember, there are 3 ways to implement a buydown:

- Seller Paid Sales Concession: The seller funds the buydown as a financial incentive for you to purchase their home. (Best case scenario)

- Buyer Paid

- A combination of Seller and Buyer Paid

Is a Mortgage Rate Buydown Right for You?

Whether or not a mortgage rate buydown is right for you depends on your individual circumstances. If you are struggling to afford a home or if you need more flexibility with your finances, a buydown may be a good option for you. However, it is important to weigh the costs and benefits of a buydown before making a decision.

Step Two: Refinance

When interest rates hopefully drop, refinance your loan to secure a lower payment to save interest over the life of your loan. It’s pretty simple: the FED lowered rates to all-time lows to prevent an economic crash during the Global Pandemic. In hindsight, they provided too much stimulus which created inflationary pressure. Now they are countering inflation by raising interest rates. There is no set timetable, but once inflation eases rates should come back down. This will likely create a Refinance Boom for those that purchased during this elevated rate timeframe. Buy low when rates are high and then refinance when rates are low.

The likely result: discounted home price and a decent mortgage rate = very happy homeowner.

How Altamont Property Group can help

Altamont Property Group is a leading provider of real estate services in the Asheville, North Carolina area. If you are interested in learning more about mortgage rate buydowns, we would be happy to help get you started. We can also help you find a qualified mortgage lender who can help you implement the buydown.

Contact us today to learn more about mortgage rate buydowns and how we can help you achieve your real estate goals in Western North Carolina. Contact us at 828-782-5582 and altamontpropertygroup@gmail.com.

How The Kim Winters Team can help

Trust the #1 Lending Team in Western North Carolina! Our expertise extends across multiple states, making us your go-to choice for primary, secondary, and investment property financing. Whether you’re considering a purchase or refinance, we have the solutions you need. Reach out to Cameron Lewis at: (828) 231-4909 or cameron.lewis@thekimwintersteam.com

You can also visit www.thekimwintersteam.com/apply to get started with your application!

NC-I-156446, VA-MLO-29880VA, GA-51749, TN-131826, FL-LO45186, SC-MLO – 643805, IL-031.0077034, AL-643805, KY- MC800629 | Movement Mortgage, LLC supports Equal Housing Opportunity. 900 Hendersonville Rd. Ste 102 Asheville, NC 28803 | NHLS:39179 | Movement Mortgage LLC. All rights reserved. For more licensing information please visit movement.com/legalNMLS ID# 39179 (www.nmlsconsumeraccess.org ) | 877-314-1499. Movement Mortgage, LLC is licensed by NC # L-142670, VA # MC-5112, GA # 23002, TN # 112748, FL # MLD200 & MLD1360, SC # MLS-39179, IL # MB.6760898, AL # 21022, KY # MC85066. Interest rates and products are subject to change without notice and may or may not be available at the time of loan commitment or lock-in. Borrowers must qualify at closing for all benefits. “Movement Mortgage” is a registered trademark of the Movement Mortgage, LLC, a Delaware limited liability company. 8024 Calvin Hall Road Indian Land, SC 29707.